Many retailers have customer cards and loyalty programs. With these tools they increase the client engagement and obtain a detailed view of their (best) customers. However, these cards will not allow them to identify directly the customers whom might churn.

With our analytical models we can pinpoint precisely which customers are at risk. This way you can monitor the size of the risk (for this client, but also for you whole client base) and keep track on its evolution over time. By knowing which triggers lead to churn, personalised actions can be planned to regain their trust even before they leave your company.

With our expertise in geomarketing we have all the necessary data, skills and experience at our disposal to predict the future behaviour of your customers. Learn in this movie how we manage to do this.

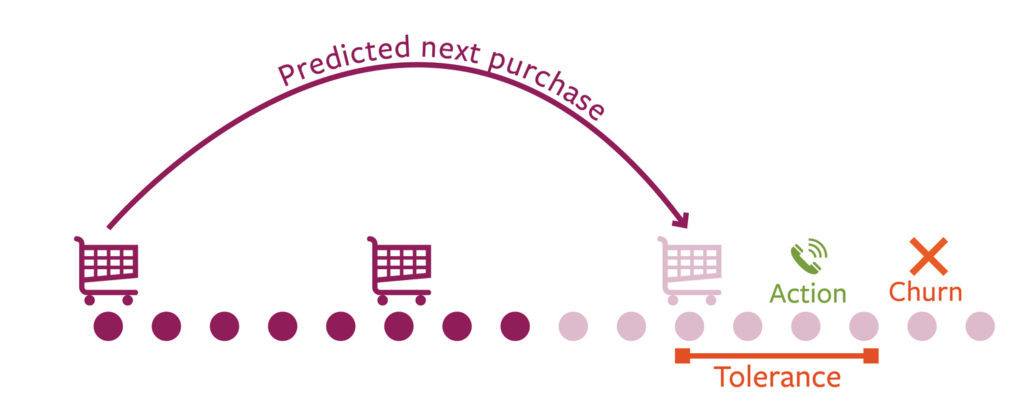

The loyalty of customer is caracterised by the purchasing cycle of each client, the category of goods, the volumes of purchases, … In this buying cycle we investigate carefully the frequency of purchases, the visited points of sale, the amounts spent, … Changes in this buying cycle; for example a decrease in the frequency of the purchases; often results in the “sudden” disappearance of the customer.

Many factors influence customer loyalty. It can be the experience of the customer with your company/product, his habits, his sociodemographic characteristics, … A few examples: a high invoice, an outdated product, the age of the customer, his income, a point of sale that has moved or closed, an untreated complaint, a campaign of a competitor, … Merely, a combination of factors explains the “sudden” disappearance of the customer.

In order to predict the future behaviour of your customers we first of all need to analyse and understand current behaviours and habits. By using historical customer data we perform an in depth study of habits and interactions of the customers of your company. Many other parameters are calculated to enrich these findings: distance to a point of sale, purchasing frequency, moment of purchase, average spending, … Finally we match your database with our Mosaic Belgium consumer segmentation in order to add rich sociodemographic information to the customers. By associating and analysing all these insights we determine which triggers result into churn and thus the factors that play an important role in the behaviour of your clients.

The integration of all these elements in a predictive model makes it possible to monitor continuously the risk of churn of your customers and to organise targeted actions.

Organise actions that match perfectly the risky client: adapt the message to his profile, his churn risk and his specific churn triggers and regain his trust! Targeted calls, mailings, promotions, exclusive test experiences, presents, … The more personalised the actions is, the highest the return will be.

With a continuous churn monitoring and personalised actions you will increase loyalty among your customers and thus increase the turnover of your company.