Managing a point of sale network is a dynamic and continuous project, requiring a careful eye to be kept on numerous aspects. This year’s economic crisis will strengthen the need for profitability, or even restructuring. Recurring questions such as “Where can we open new stores? Where can we increase our market share?” are gradually giving way to thoughts about rationalisation: “What is the impact of a store closure or relocation? How can we maintain good market coverage with fewer points of sale?”.

Geomarketing analyses including market data and predictive models make it possible to identify the strongest links in your network and prioritise your actions in relation to lower-performing outlets. Discover in this article the essential elements that need to be analysed in order to ensure a realistic and cost-effective development or adjustment of your point of sale network.

The lockdown and the looming economic crisis raise many questions. Before making any drastic decision, it is important to take a step back and analyse the events in a global context.

Consumer habits have been completely changed during the lockdown. It is therefore not prudent to base your decisions solely on the observations collected during this anomalous period. Several reports indicate that a significant portion of consumers are simply postponing their purchases without resorting to online outlets. Rather, the current situation appears to reflect the maximum threshold of digitalisation that our society is prepared to accept.

In order to monitor the changes in your customers’ behaviour, you should gather and analyse the purchases over the period preceding the lockdown. Compare this data with the data that you will be collecting over the coming months. This analysis will help you to determine how many of your customers have actually changed their behaviour in a lasting manner, as well as the characteristics of this new type of customer.

Some retailers are facing financial difficulties and thinking about restructuring their point of sale network. In order not to close stores with significant growth potential or stores that are profitable (but with a lower turnover), we recommend that you carry out detailed market analyses. With adequate data and the right analytical approaches, you can quantify the impact of a closure of each point of sale and thus determine the true performance of each of them.

“Any network manager must have, in the short term, a clear view of the performance of its network. They must be able to identify over- and under-performing stores, as well as stores with or without growth potential.”

Olivier Janssens de Bisthoven, Partner & Analytics Expert at SIRIUS Insight

One of the fundamental concepts of marketing is “location, location, location”. If your target group is not located where you open your point of sale, that point of sale will not achieve the desired result. The more you address yourself at a niche (households that consume organic products, affluent households, older couples, etc.), the more important this aspect becomes. SIRIUS Insight’s data, including the Mosaic Belgium consumer segmentation, is a major asset for defining and locating your target group.

A network’s best results can be achieved if the location of each point of sale is very carefully defined. To achieve this, it is useful to try a strategic exercise in which no point of sale is fixed beforehand. This involves determining the network by taking into account the presence of the target group, the existing competition and the accessible market potential. This approach makes it possible to obtain an ideal network with points of sale that do not suffer from internal competition and offer the best market coverage.

There are numerous questions to be tackled in relation to the point of sale network. Especially when you want to transform your network. It becomes a complex matter to determine which stores to keep, which to merge, and where to open new ones. The approach is often based on “feeling” and some internal indicators. Few businesses are really equipped (in terms of data and geomarketing models) to make an objective determination of the true performance of a point of sale.

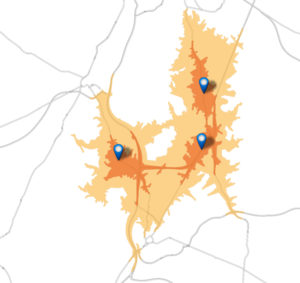

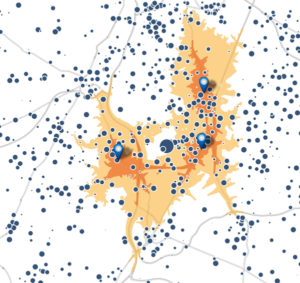

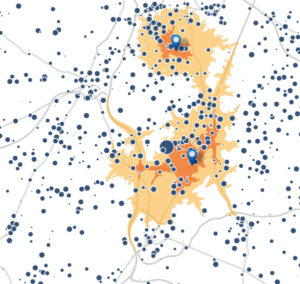

An example will help to simplify the issue. In the first illustration, you see three points of sale and their catchment area. In the second illustration, you see the accessible market potential. By comparing these two figures, we can identify the internal competition and an out-of-centre market potential with respect to the location of the store. The third illustration shows that the same market potential can be captured with just two points of sale, thus eliminating the effects of internal competition.

In addition to the presence of the target group, other parameters need to be monitored to ensure cost-effective development of the network. It is a question of configuring the network to optimally cover the market potential, minimise cannibalisation and cope with competitive pressure.

Often, the location of the points of sale does not take the accessible market potential into account. This market potential represents the budget that the households within a specific area spend on your product/service. If you ensure that this potential is well covered, the performance of your network will increase.

Arising as they do from a long history of real-estate opportunities and the “feeling” of the manager, networks do not take sufficient account of cannibalisation effects. Consequently, catchment areas overlap, producing internal competition. Geomarketing analyses can inform you about the impact of this internal competition and the actions to be taken (relocation, closure, etc.) to ensure the best allocation of your resources.

Competitive pressure is closely linked to the business sector, the size of the competing networks, their power and their positioning. These characteristics determine the share of the market potential that each network captures. In some business sectors, this local competition is actually beneficial. This is true for fashion stores in particular. Despite a positioning and target group unique to each brand, consumers need a global offer in order to be able to compare collections and choose the items they prefer.

The economic, technological and competitive environment is constantly changing. The same is true of consumers’ behaviour, which adapts to all of these changes. These developments have a continuous impact on business sectors, with occasional accelerations. The key moments for conducting in-depth analysis of your network can be summarised in three scenarios: growth, transformation, consolidation.

Whether you are a new player in the business or an established retailer, when you have a real growth target, you need to know exactly where to invest. Small players often think they cannot afford a strategic study. But players of modest size are exactly the ones that cannot afford to make bad decisions. When a network of points of sale is already in place, it is the search for uncovered market potential that takes centre stage.

Digitalisation, economic crises, technological developments and behavioural changes are just a few examples of events that prompt companies to adapt their point of sale network. These developments have an impact on buying and consumption habits. The network must regularly adapt to these changes and deploy the number of points of sale strictly necessary to ensure optimum coverage of the market potential.

Even in a stable or gradually changing market, regular analysis of the point of sale network remains a profitable investment. Depending on the business sector and the speed of change, SIRIUS Insight recommends that you carry out a fresh performance audit on your network every five to seven years and adapt the network accordingly.

For more than 30 years, SIRIUS Insight has been supporting companies in various business sectors with the development and adjustment of their point of sale networks. Thanks to this experience and the continuous improvement of analytical models, we provide a comprehensive and reliable response to network optimisation needs. Contact us.