The location of a store is by far the most important element affecting its operation. Whatever your sector of activity, when you choose a location, you choose your potential customers. In this article, our geomarketing experts show you the most important elements in the search for locations for the opening of a store.

SIRIUS Insight is a consultancy company specialising in geomarketing strategy. Our customers rely on us to develop their retail network, manage their target groups and obtain up-to-date consumer and market data.

The opening of a store most often happens as part of a larger development project. Unless you have a well-defined development area, it is important to analyse your development project in the context of your market.

Before looking into the characteristics of a specific location (visibility, ancillary businesses, local competition, etc.), we recommend taking a step back and analysing your overall context.

By defining your market, target group and competition, you will be able to test the feasibility of your development plan, locate areas for expansion and identify the most critical levers in your development.

Before looking for interesting locations to open a store, it is essential to have a clear view of your business, its price and service level, its market and its target group. Think strategically about your offer, the consumer at whom it is addressed and the competition that you face.

“Before deciding where you want to open a store, define for whom you want to open a store.”

What products will you offer to what type of customer? Who is that customer? How do they behave? How do they consume? What is their standard of living? Where are they located? In what market is your business situated? Who are the competitors? Is this competition head-to-head, partial or beneficial? Are the competitors addressing exactly the same target group?

The answers to these questions will help you get closer to the consumers most interested in your offer and adopt the most appropriate strategy in the face of your specific competition.

The most important thing for your development is to open your stores precisely where your target group is located. This statement hides two essential components: the volume of consumers AND the characteristics of those consumers.

“Both the number and the characteristics of the potential customers are essential in the choice of location for your store”

With the exception of a few rare retailers that target almost all consumers, the vast majority of retailers have a more limited target group. By defining and locating this target group, you can address your offer at the consumers most interested in your products. Regardless of your sector of activity, most of a store’s turnover is generated by the closest customers.

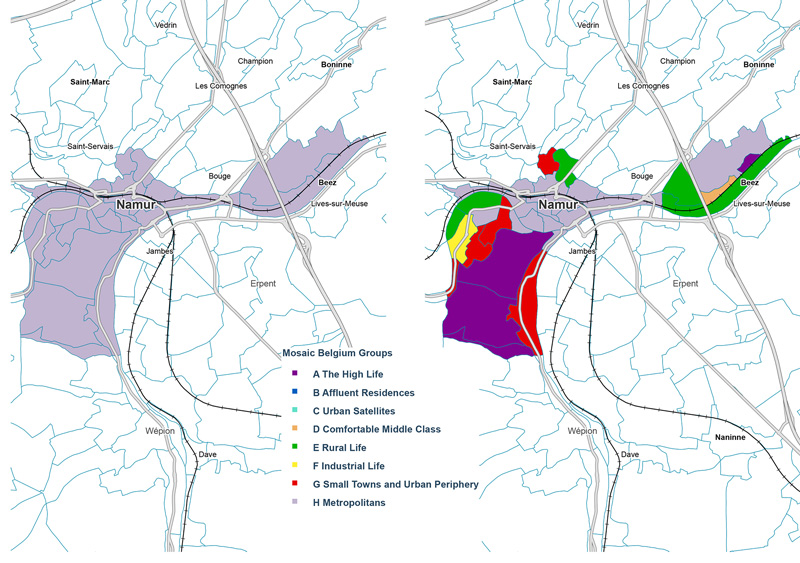

Consider, for example, the target groups of a pet shop, a fashion store, a sandwich shop, a specialist in organic products, etc. Some brands are aimed specifically at city dwellers, others at consumers in their place of work, or at consumers interested in organics. These different types of consumers are not evenly distributed and do not consume in the same way. To define and locate your target group, at SIRIUS Insight we use the Mosaic Belgium consumer segmentation.

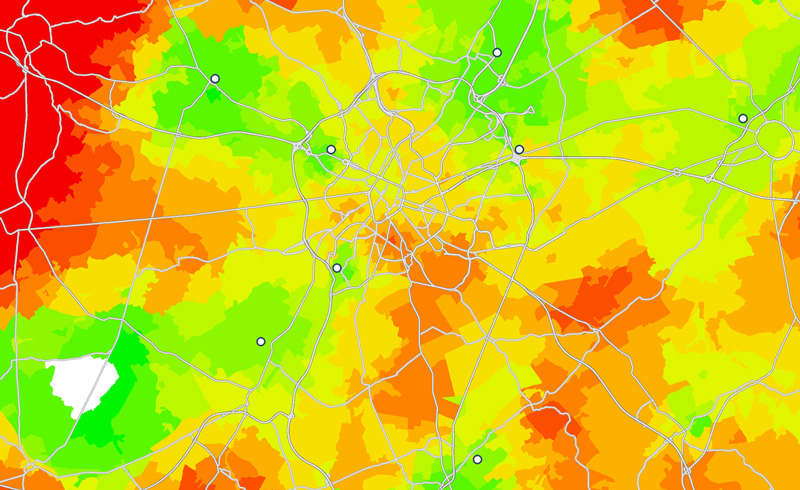

Strongly linked to the presence of the target group, the market potential represents the commercial interest of your offer. Often located at census district or postcode level, the market potential represents the cumulative amount that local households spend on your product types. Depending on the offer, this market potential may be represented in terms of monetary value, number of individuals, number of households, number of vehicles, number of bicycles, etc.

This data is valuable, especially for identifying areas with high potential. It is also on the basis of this market potential that a turnover can be estimated using reliable analytical models.

Competition and other attractors also play an important role in defining the expansion plan and finding interesting locations.

Let’s start with competition. As a tactical element, competition can be exercised in very different ways depending on the sectors of activity. Consider, for example, car dealerships or fashion stores. With these types of outlets, the presence of competition is generally beneficial. A tactical approach will often involve taking up a presence in the area where the competitors are located. These are some sectors where customers have quite varied profiles and like to visit several different stores to compare products. In other sectors, such as the food trade or pharmaceutical distribution, this competitive pressure is exerted differently. Consumers generally buy from one or two stores, and the existing offer is already very dense. The appeal of placing a food store or a pharmacy right alongside its competitor is rather limited.

Then there is a whole series of complementary attractors. It is a matter of identifying the businesses or points of interest that will generate a flow beneficial to your own business. Think, for example, of the parapharmacies that set up in shopping centres, the minimarkets that place themselves next to hairdressers, etc.

A new store in an existing network

So far, this article has focused on the opening of a single store. The opening of such a store generally takes place in the context of an already developed retail network. This network makes it possible to learn a lot about the existing stores. Think in particular about the store’s influence, the interaction with competitors, the profile of the customer base, etc. These different elements can then be taken into account in the search for new locations.

Look also at the impact that the opening of the store will have on the other stores in your network. In many sectors, we see a high degree of cannibalisation between stores of the same chain. Sophisticated analytical models allow prior quantification of the collateral impacts of an opening project.

When you entrust your development project to our geomarketing experts, you can be certain that you will receive high-quality support. Our analytical team is trained continuously, and has up-to-date data and advanced and reliable methods at its disposal.

By outsourcing the search for locations, you can not only focus on your business, but also take the necessary step back in order to make decisions on objective grounds.

Whether you need a location report, a turnover estimation, a search for areas of expansion, development or audit of the network, etc., our experts are here to support you in your company’s development. Contact us to discuss your project.

The search for locations takes place in two major steps. Firstly, an analysis of the potential market will identify any hotspots are expansion areas. These expansion areas contain consumers interested in your offer, in sufficient numbers to represent an adequate potential market. The level of competition corresponds to the specific characteristics of your sector.

After this macro analysis, the work of searching for locations within the hotspots begins. The best location for the store opening will be the one that has good visibility for the target audience. Various elements help you to determine the most favourable location: the profile of the local population, traffic, footfall, presence of complementary attractors, etc.